seattle payroll tax calculator

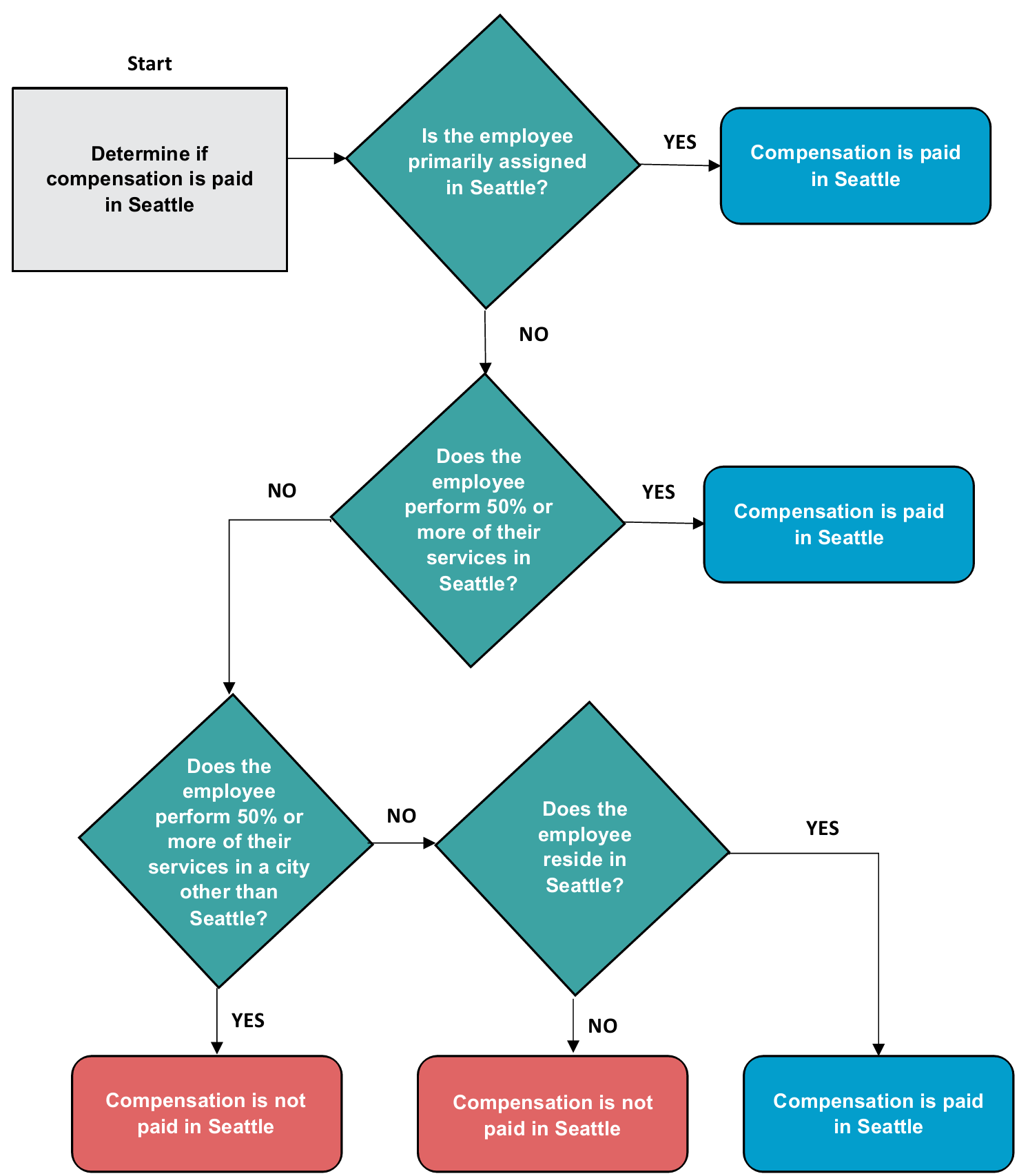

Move forward to July 2020 and the Seattle City Council passes another form of payroll tax. Seattle businesses must choose the method theyll use to determine how to assign payroll tax liability to the city at the beginning of the year for the citys business tax targeting businesses.

New Seattle Jumpstart Tax Overview Rates More

Ad Process Payroll Faster Easier With ADP Payroll.

. W2s were mailed to non-consenting and former employees during the week of January 17 2022. Gross Pay Calculator Plug in the amount of money youd like to take home. Discover ADP For Payroll Benefits Time Talent HR More.

After a few seconds you will be provided with a full breakdown. Rates also change on a yearly basis ranging from 03 to 60 in 2022. Washington Hourly Paycheck Calculator.

The payroll tax also called JumpStart tax was passed by Seattle City Council in June 2020 and went into effect on January 1 2021. Use the paycheck calculator to figure out how much to put. This number is the gross pay per pay period.

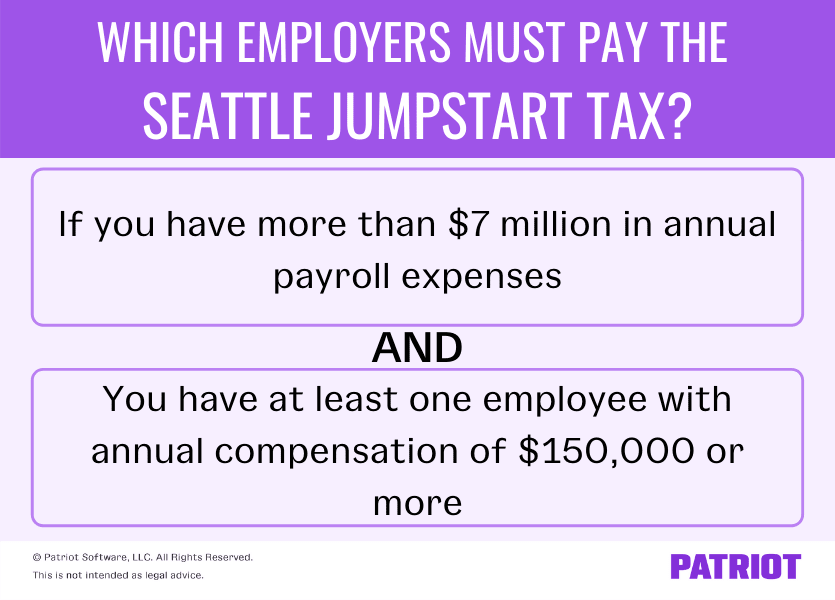

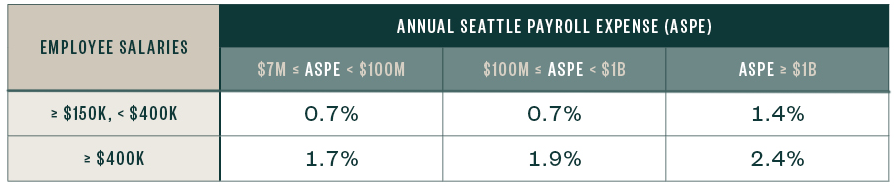

While taxpayers in Washington dodge income taxes they pay. The tax rate ranges between 7 and 24 and is based on both the annual compensation paid to each employee and the total Seattle payroll expense of the business. Get Started With ADP.

What Are The Taxes On 1000 Paycheck. Ad Process Payroll Faster Easier With ADP Payroll. Another thing you can do is put more of your salary in accounts like a 401k HSA or FSA.

Get Started With ADP. It is not a substitute for the. The highest tax only applies to companies with 1 billion or more in payroll and only.

The payroll expense tax also known as JumpStart Seattle City Ordinance 126108. The 2021 payroll tax rates range from 07 to 24 and are subject to change annually. To use our Washington Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button.

Subtract any deductions and. For 2022 the wage base is 62500. Although the tax has been in effect for the.

Discover ADP For Payroll Benefits Time Talent HR More. It can also be used to help fill steps 3. The City of Seattle Washington will impose a new employer-only Payroll Expense Tax effective 1 January 2021The filing of this tax was optional until Q4 2021and Zenefits is supporting this.

The Seattle payroll tax is measured by the payroll expense of the business times a rate that varies based on the businesss total Seattle payroll expenses and the compensation. Hourly Paycheck Calculator Enter up to six different hourly rates to estimate after-tax wages for hourly employees. On March 22nd the reception area will have regular in person hours on Tuesday thru Friday 900 AM - 400 PM closed on Mondays until further notice.

An employees gross pay for every paycheck is used to calculate the percentages. The information provided by the Paycheck Calculator provides general information regarding the calculation of taxes on wages for Washington residents only. If you contribute more money to accounts.

2021 Social Security Payroll Tax Employee Portion Medicare Withholding 2021 Employee Portion To contact the Seattle Department of Revenue please. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. Washington is one of several states without a personal income tax but that doesnt mean that the Evergreen State is a tax haven.

Assuming a gross pay of 1000 an employee. To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. Washington State Unemployment Insurance varies each year.

Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. The Seattle Times developed a calculator to estimate how much you may pay in lifetime and annual premiums into the Washington states new long-term care program. Please contact payroll at payrollseattleuedu if you have not.

Blog Akopyan Company Cpa Seattle Accounting Firm Taxes Payroll Payroll Accounting Firms Cpa Marketing

Washington Income Tax Calculator Smartasset

Payroll Clerk Salary Comparably

Seattle S Payroll Expense Tax On Salaries Of Top Earners Bader Martin

Seattle S Payroll Expense Tax Upheld By Trial Court Time For Employers To Gear Up For Reporting Insights Davis Wright Tremaine

Washington Income Tax Calculator Smartasset

Seattle Payroll Expense Excise Tax Details

How To Calculate Your Real Cost Of Labor Remodeling

Coding Salaries In 2019 Updating The Stack Overflow Salary Calculator Stack Overflow Blog

What Is The Tax Rate In Seattle Usa Quora

Seattle S Payroll Expense Tax Upheld By Trial Court Time For Employers To Gear Up For Reporting Insights Davis Wright Tremaine

Equivalent Salary Calculator By City Neil Kakkar

New Tax Law Take Home Pay Calculator For 75 000 Salary

Washington Income Tax Calculator Smartasset

How Seattle S New Payroll Tax On Amazon And Other Big Businesses Will Work Geekwire

Gusto Help Center Washington Registration And Tax Info

Here S How Much Money You Take Home From A 75 000 Salary

The Seattle Payroll Expense Tax What You Need To Know Clark Nuber Ps